how likely will capital gains tax change in 2021

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Passing such a change to capital gains rates is most likely to occur when Congress can turn its attention away from the COVID-19 crises.

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

By Katey Pigden 27th October 2021 347 pm.

. And if retroactive taking. Historically major changes to US tax policy have not been retroactive. A key issue is whether the change would apply retroactively to April 2021.

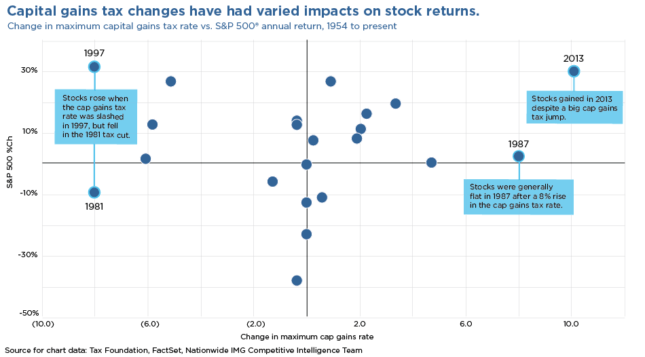

It seems unlikely they will pass. History is a good indicator of the impact of a capital gains increase on. A key issue is whether the change would apply retroactively to April 2021.

Business owners need to balance concerns about impending tax changes with considerations around maximising the value of their businesses before deciding when to sell. By Brian Faler. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some.

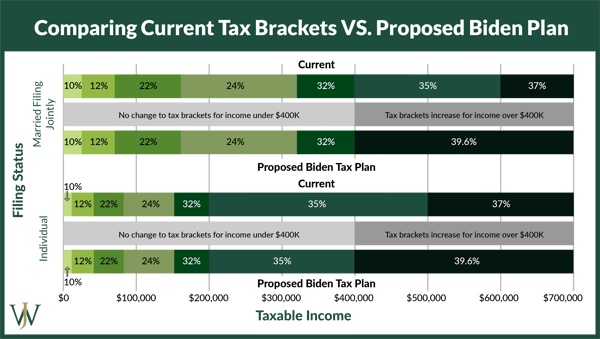

Democrats will likely drop hundreds of billions of dollars in proposed tax increases on the rich as they scramble to shrink the size of. Capital Gains Tax UK changes are coming. 0 if your.

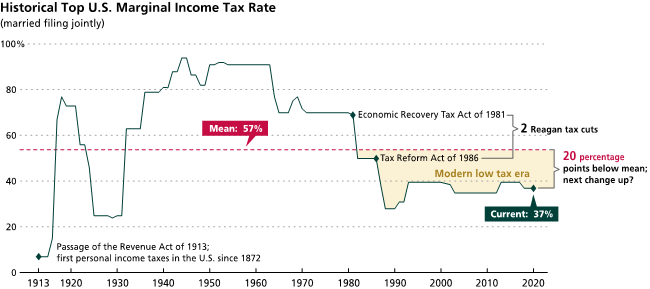

In the US short-term capital gains are taxed as ordinary income. The chart below illustrates how the change in capital gains tax rates affects the sellers net proceeds. Apr 23 2021 305 AM Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

That means you could pay up to 37 income tax depending on your federal income tax bracket. Any increase will likely not be effective until 2022. Taxpayers subject to the net investment income tax pay another 38 currently and would continue to pay that after any of the proposed increases are enacted.

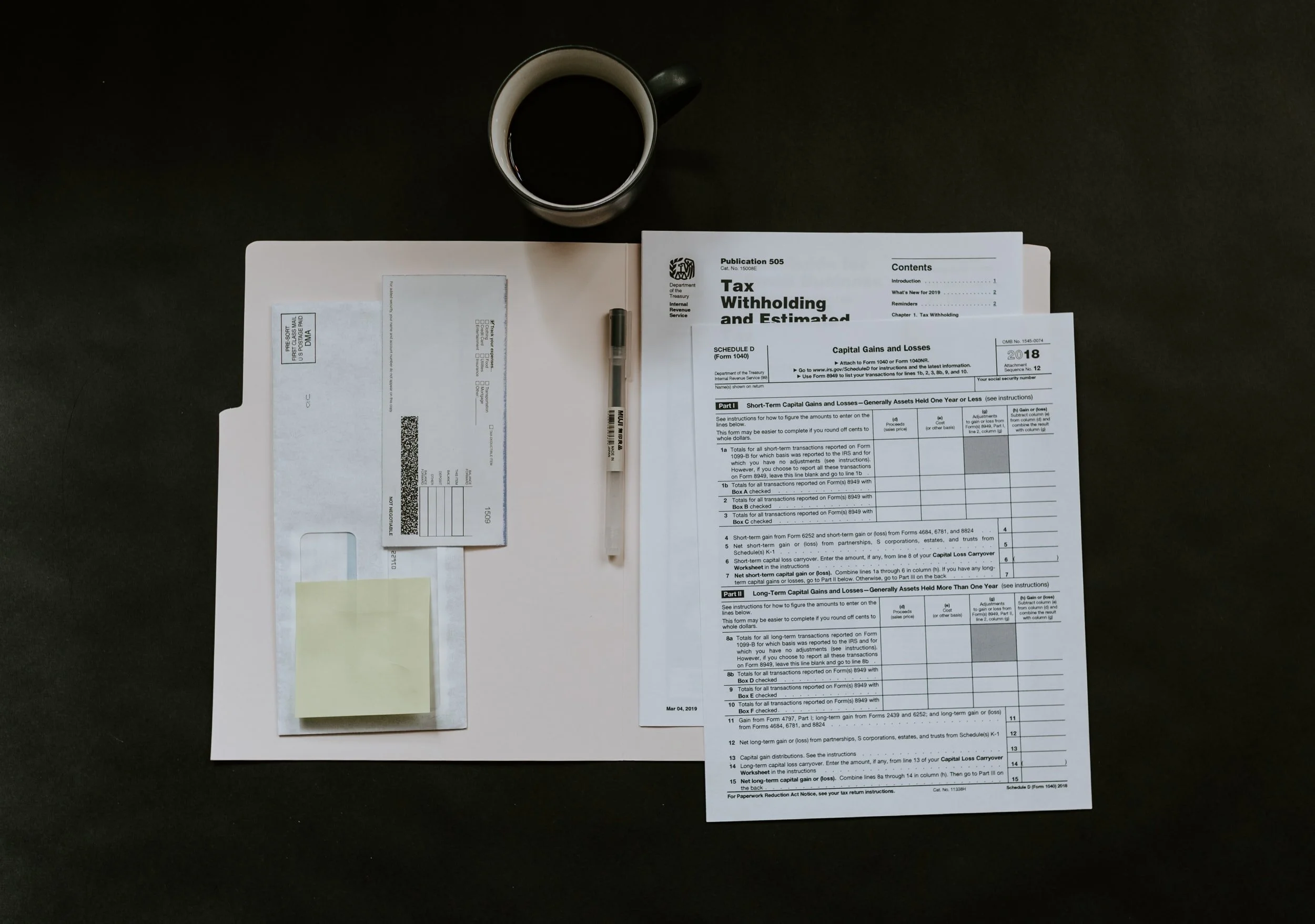

First deduct the Capital Gains tax-free allowance from your taxable gain. Add this to your taxable. Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or in future.

10082021 0430 AM EDT. According to the Internal Revenue Service IRS tax rates for long-term capital gains depending on your income and marital status remain the same for 2021 at. PoolGetty Images Capital gains tax is likely to rise to near 28 rather.

Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high. Chancellor Rishi Sunak swerved making any major changes to the tax people pay when they sell assets such as a second home. Tax Changes and Key Amounts for the 2022 Tax Year.

The capital gains tax-free allowance for the.

Capital Gains Tax Washington State Changes In 2021 Mainsail Financial Group

Capital Gains Hike Won T Affect Stock Market Experts Say But Wealthy Scramble

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

How The Potential Tax Changes Can Impact Your Investments Chase Com

Preparing For Capital Gains Tax Increases In 2021 Diamond Associates Cpas

Stock Market Outlook Higher Capital Gains Taxes Won T Derail Equities

Lifetime Tax Planning Amidst Uncertainty Keating Wealth

Selling Your Business In 2021 How Capital Gains Tax Changes Might Affect You Calhoun Companies

Proposed Us Tax Changes 2022 What You Need To Know Right Now Sovereign Research

An Overview Of Capital Gains Taxes Tax Foundation

One Benefit Of Biden S Capital Gains Tax Hike Fewer Mergers

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Potential Biden Proposed Tax Changes Becoming Clearer Amg National Trust

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Managing Capital Gains Tax In 2021 And Beyond Ultimate Estate Planner

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool